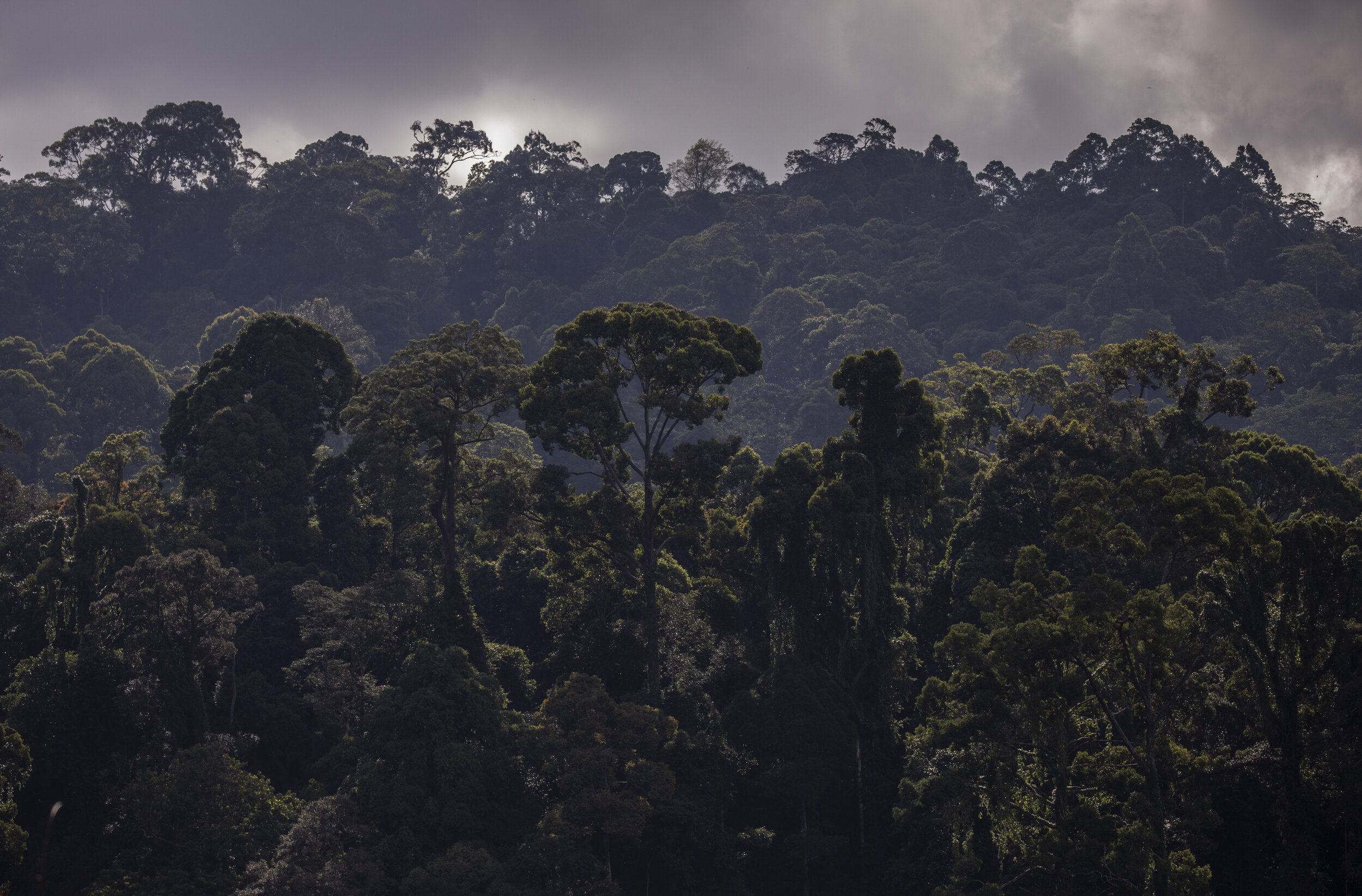

© Panos Photography / FOLU

£150 million UK Government blended finance programme to mobilise private sector investment and protect tropical rainforests across Africa, Asia and Latin America

Mobilising Finance for Forests (MFF), is a blended finance programme launched by the UK Government in March 2021 which aims to combat deforestation and support sustainable land use practices by creating a new mechanism to mobilise private capital into the Forest and Land Use sector.

MFF is structured as a fund of funds and will allocate up to £150 million, and leverage up to £850 million of private sector investment, into Forest and Sustainable Land Use projects with high mitigation benefits in selected tropical forests in the Amazon Basin, Africa and Asia over five years (2021-2025).

It will support projects that create value from existing forest stocks and incentivise their protection (eg. harvesting non-timber forest products such as nuts and native forest coffee, carbon offsetting schemes, eco-tourism and conservation projects), and projects that incorporate forest protection into agricultural production of sustainable commodities (eg. cattle, soy, palm oil, timber, agroforestry and cocoa).

In doing so, the programme expects to protect 2.1 million hectares of tropical rainforests from deforestation and to reduce CO2 emissions by 28 million tonnes over the next 15 years, equivalent to the offsetting London’s entire CO2 emissions annually. It also aims to create thousands of green jobs and improve the lives of over 600,000 small-scale farmers and food producers.

The programme will be delivered in partnership with FMO, the Dutch entrepreneurial development bank, which will aim to co-invest up to £36 million of its own capital into the project.

Energy Minister Anne-Marie Trevelyan said: “The impact of deforestation is devastating – on those vulnerable rainforest communities, and on global efforts to combat climate change. And the health of the earth’s tropical forests is critical to the health of our planet – we need to do all we can to protect and preserve this vital ecosystem. Today’s new fund will ramp up investment in projects on the frontline of this effort, while also giving financial institutions the confidence they need to invest, which could attract and secure as much as £850 million from the private sector.”